TGM CONSUMER SENTIMENT SURVEY IN THE US 2024

What Changes are American Consumers Making to their Spending Habits?

What Changes are American Consumers Making to their Spending Habits?

Amid concerns over increasing prices and financial security, American consumers are reevaluating their spending priorities. Heightened apprehensions regarding rising costs and financial stability are two predominant concerns that have led to a reconfigured economic landscape. This substantial transformation has not only enhanced consumer awareness but also spurred notable shifts in spending patterns. Our article delves into the heart of these dynamics, elucidating the influence of inflation on the attitudes and behaviors of consumers across the United States.

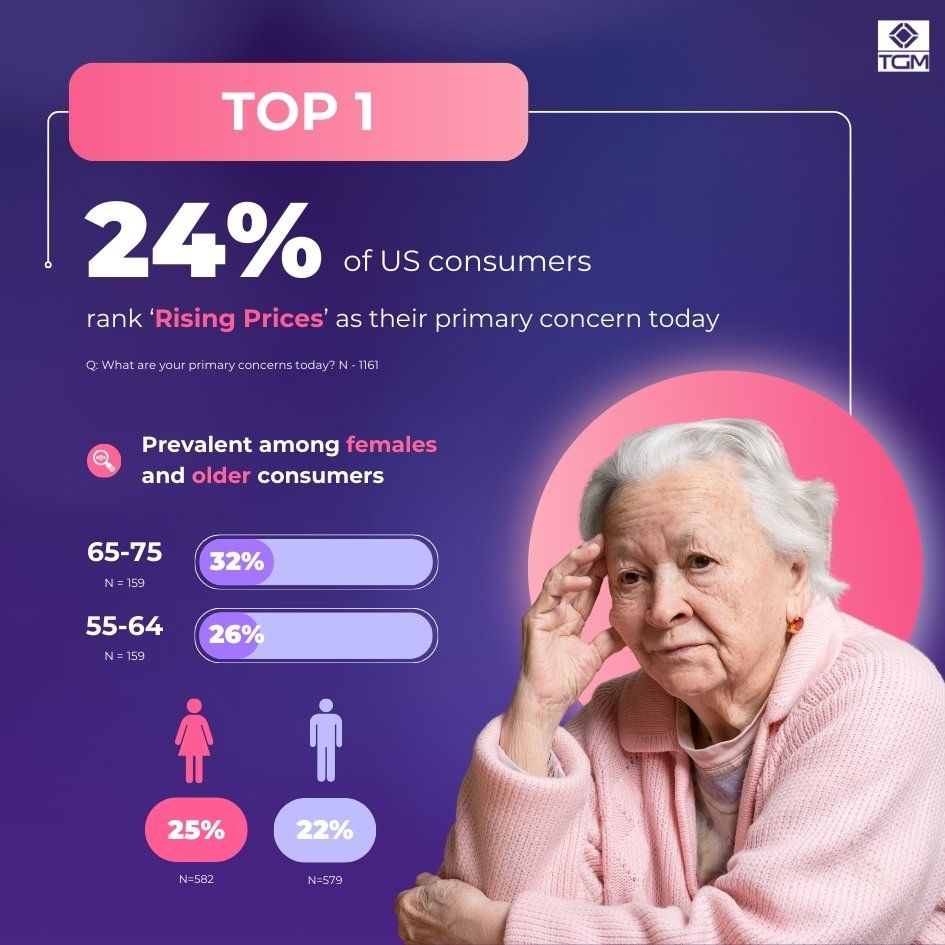

TGM Consumer Sentiment Survey in the US 2024 reveals 24% of American consumers rank ‘rising prices’ as their top 1 concern today, with predominantly females (25%) and individuals aged 65-75 expressing the highest level of apprehension, reaching 32%.

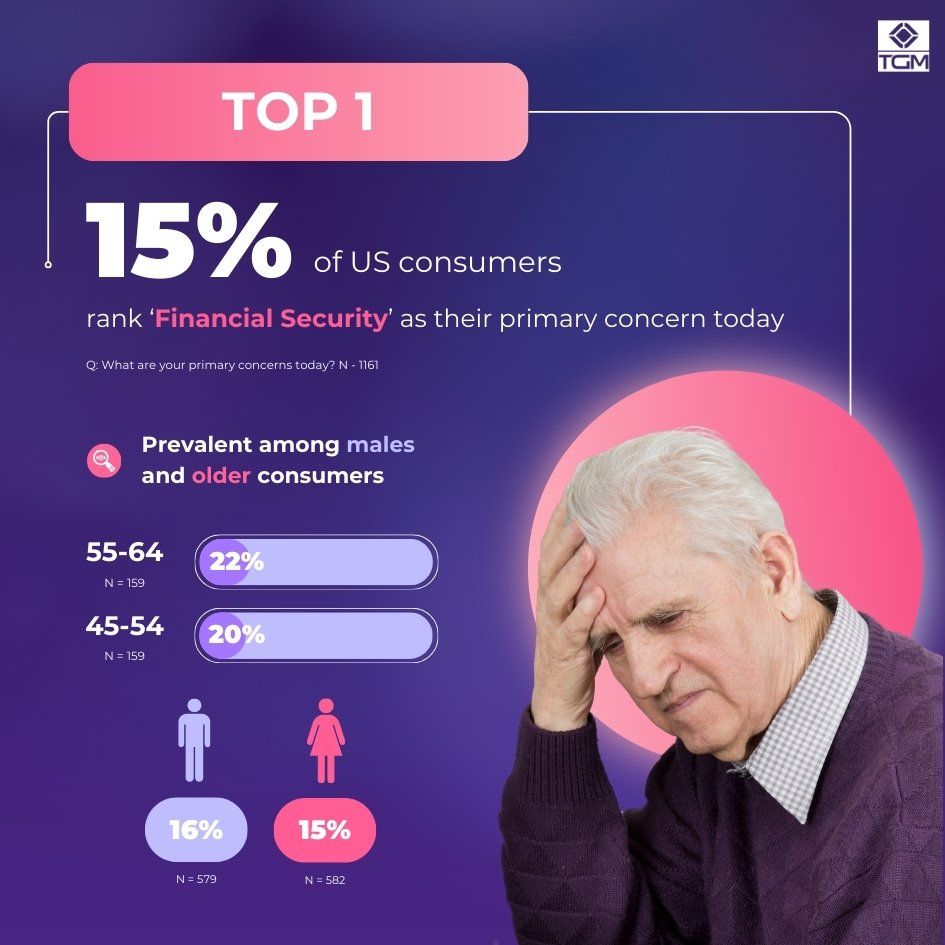

TGM Consumer Sentiment Survey in the US 2024 reveals 15% of American consumers rank ‘financial security’ as their top 1 concern today, with predominantly males (16%) and individuals aged 55-64 expressing the highest level of apprehension, reaching 22%.

Rising Prices and Financial Security Impact Consumer Behavior

The question is: Where are US consumers cutting their spending? What are their spending priorities in the next three months?

Anticipated Changes in Spending Habits

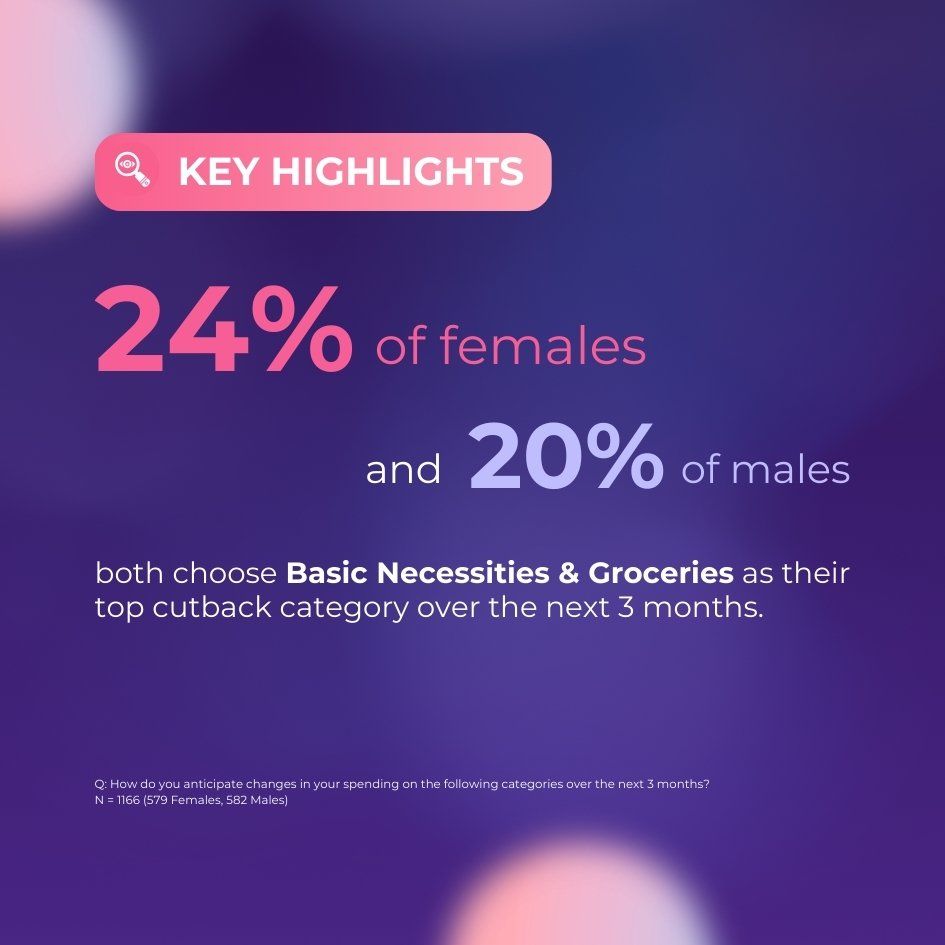

Looking closely, gender disparities in spending priorities are apparent between male and female consumers. Specifically, 38% of males in the US intend to increase their spending on ‘energy/utilities’, while 20% aim to reduce their spending on ‘basic necessities & groceries’ over the next three months. In contrast, among females, 36% anticipate higher spending on ‘transportation and fuel’ over the next three months, while 24% plan to scale back on ‘basic necessities & groceries’.

Navigating Change and Seizing Opportunities

- Emphasize the long-term value and durability of your product or service to validate the price points and reassure consumers about the lasting advantage of their investment.

- i.e. Showing superior craftsmanship and innovative features of your product or service to provide consumers peace of mind regarding its lasting benefits.

- Be transparent about pricing or any potential price increases, openly communicate with consumers about the reasons behind changes and your efforts to minimize their impact

- i.e. “We've adjusted prices on certain fruits and vegetables due to weather-related challenges, but we're working to minimize the impact on your budget by negotiating with suppliers and improving supply chain efficiency.”

- Provide exceptional customer support to address concerns or questions about pricing, offering personalized assistance and guidance to help consumers make informed purchasing decisions.

- i.e. Introduce a flexible payment plan for customers who are struggling to pay in the hope of easing their financial strain and make it more manageable.