TGM Consumer Sentiment Survey in the US 2024

Branded vs. Store Brands: The Rise of Private-Label Brands in the US

Branded vs. Store Brands: The Rise of Private-Label Brands in the US

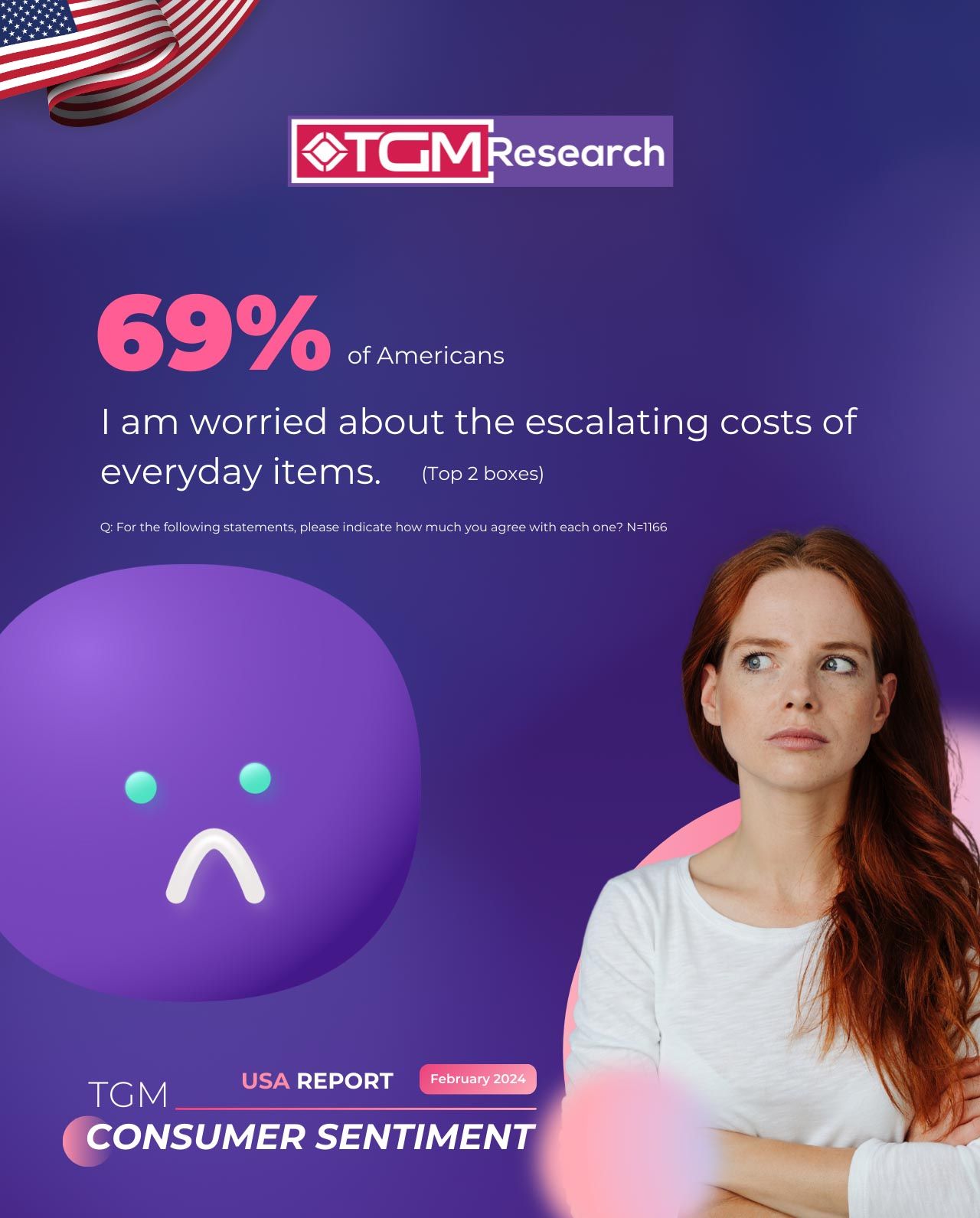

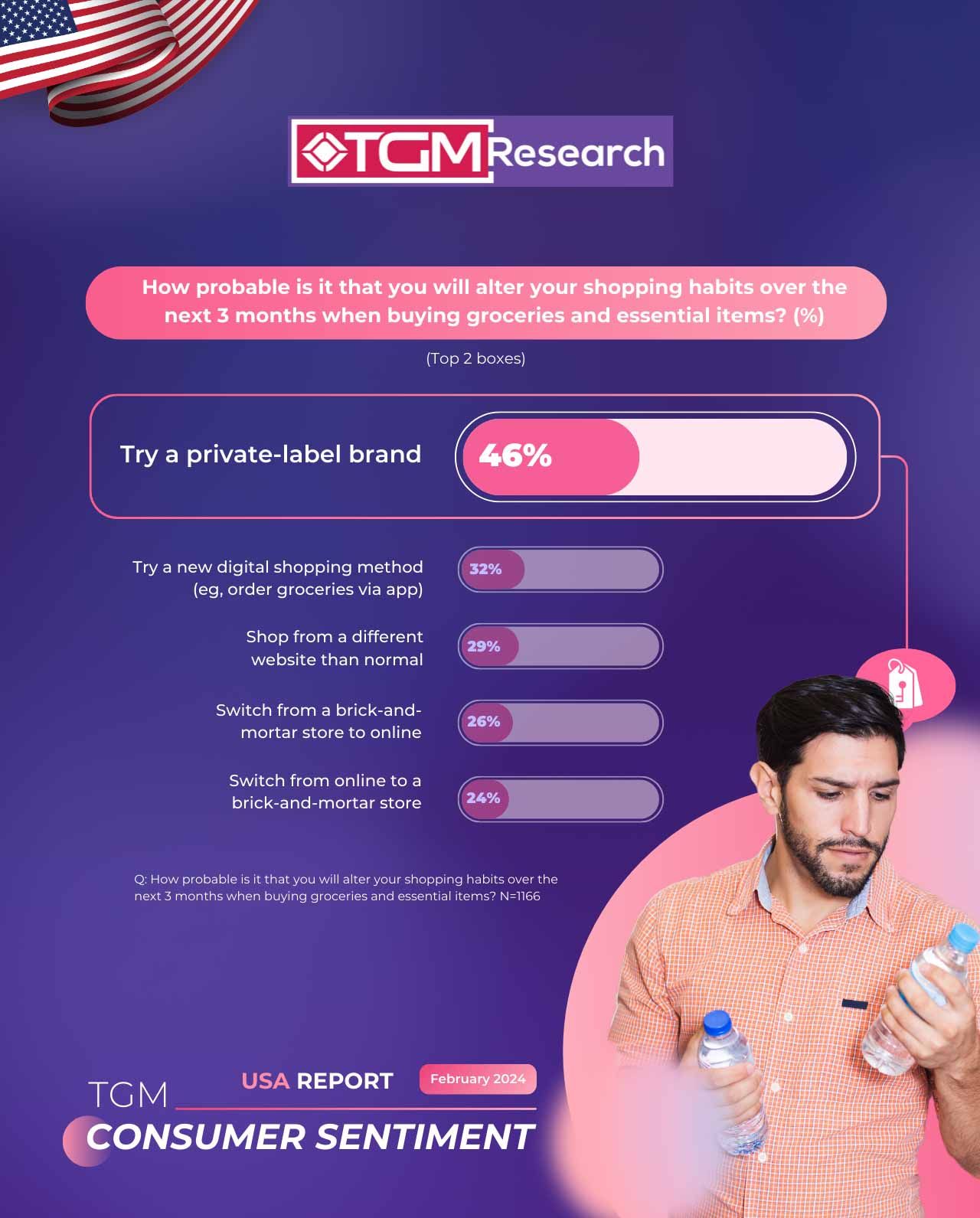

The global community has been grappling with various challenges, ranging from supply chain disruptions to inflationary pressures, resulting in widespread concerns regarding escalating costs. According to the TGM Consumer Sentiment Survey in the US 2024 , a staggering 69% of Americans express deep concerns about the continuously increasing costs of everyday items. This anxiety is particularly pronounced among individuals aged 55-64, who find themselves at the forefront of financial strain. Consequently, there has been a discernible shift in shopping behaviors, with many seeking alternatives to mitigate the impact of increasing expenses.

One notable trend that has gained considerable momentum is the proliferation of private-label brands. During the first half of 2023, culminating on June 18th, private label dollar sales experienced an impressive 8.2% surge, soaring to an astounding $108 billion, as reported by Circana, a prominent market research firm headquartered in Chicago. Despite a marginal 0.5% decline in store brand unit sales during this timeframe, they outshone national brand unit sales, which plummeted by 3.4%. This shift underscores the evolving perception of private label brands, once perceived as generic substitutes, now commanding significant consumer attention and loyalty across diverse industries.