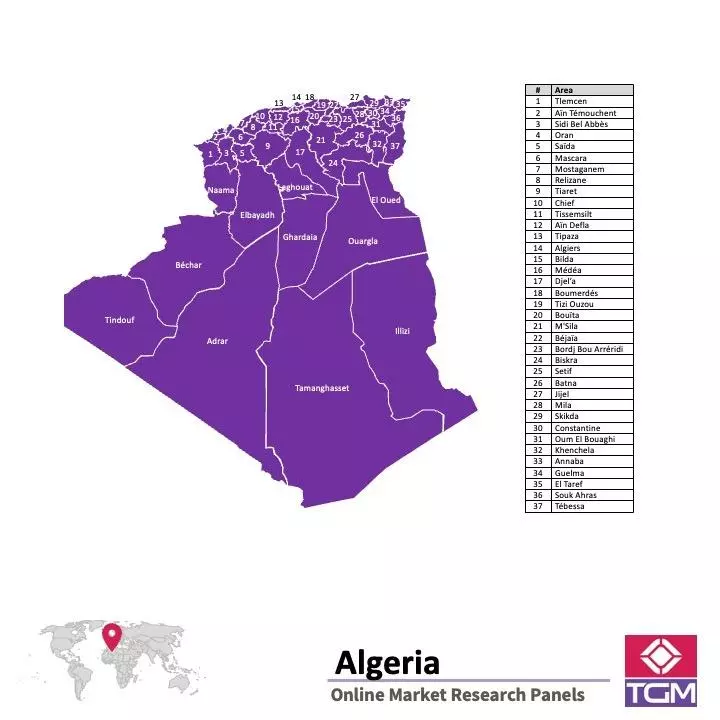

Get Rapid Results in Algeria with TGM Omnibus Research Solutions

Algeria Rapid

Survey mini Omnibus

At TGM Research, we understand the importance of accurate and up-to-date market research data in Algeria. That's why we offer our clients TGM Fast Omnibus Research Solutions. Our TGM overnight omnibus research solutions allow you to quickly and easily gather valuable market research data, so you can react fast to your burning questions, competitor activity, and market events in Algeria.

Our solutions enable you to make data-driven decisions, rather than relying on guesses, without compromising your speed to market. With our fast turnaround and device-agnostic approach, you can trust that we will provide you with the information you need to stay ahead of the competition in Algeria.

Contact us today to learn more about how our TGM Fast Omnibus Research Solutions can benefit your business in Algeria.

Why TGM Research Rapid Omnibus?

-

-

Reach a nationally representative sample of 500 adults aged 18+.

*Online representative when national representative not possible. Contact us to discuss detailed sampling plan

-

-

-

Survey results delivered as fast as 3 days. All with full-service support and live reporting.

-

-

-

Agile Schedule – can be launched on custom date if more than 5 questions commissioned

-

Speed - Cost-effectiveness - Representativeness

TGM Fast Omnibus Research Solutions are designed to deliver instant results, thanks to our efficient processes and automation employed at setup, fieldwork, or data delivery.

Our device-agnostic approach ensures that we can capture responses from those who are always on, no matter where they are.

TGM Rapid Omnibus Surveys Solutions are ideal for:

-

Exploring or understanding specific issues, usage, behavior, feelings, etc.

-

Testing a hypothesis or screening alternative choices.

-

Getting input into the development of consumer insights.

-

Getting spontaneous reactions to products, media, etc.

-

Understanding reactions to an event, a crisis, etc.

-

Monitoring competitor activity, and more.

350$

per question.

How much does it cost?

Why to coduct your survey project in Algeria with TGM Research?

At TGM Research, we are proud to offer our clients a global reach and full support. Our ability to research national representative samples, as well as target regional and niche audiences across the world, sets us apart in the industry.

With our dedicated team member handling your whole project on every stage, including survey design, translations, scripting fieldwork, and results delivery, you can trust that your project is in good hands.

We are confident in our ability to deliver your multi-market insights in a timely manner, often within one week or even sooner. Trust us to provide you with fast, reliable and accurate results.

How does it work?

-

1

We use a national representative sample of up to 500 interviews in Algeria and up to 15 mobile-friendly question units asked among the panelists (or high-quality preferred panel providers where TGM panels are not available). -

Data delivery as fast as 3 days, and we deliver instant updates within hours or days depending on countries and your needs.

TRUSTED BY THE BEST

already use TGM Research: